SEC Schedule 13D / 13G Filing Made Simple

Stay Compliant When Crossing the 5% Ownership Threshold

What is Schedule 13D / 13G?

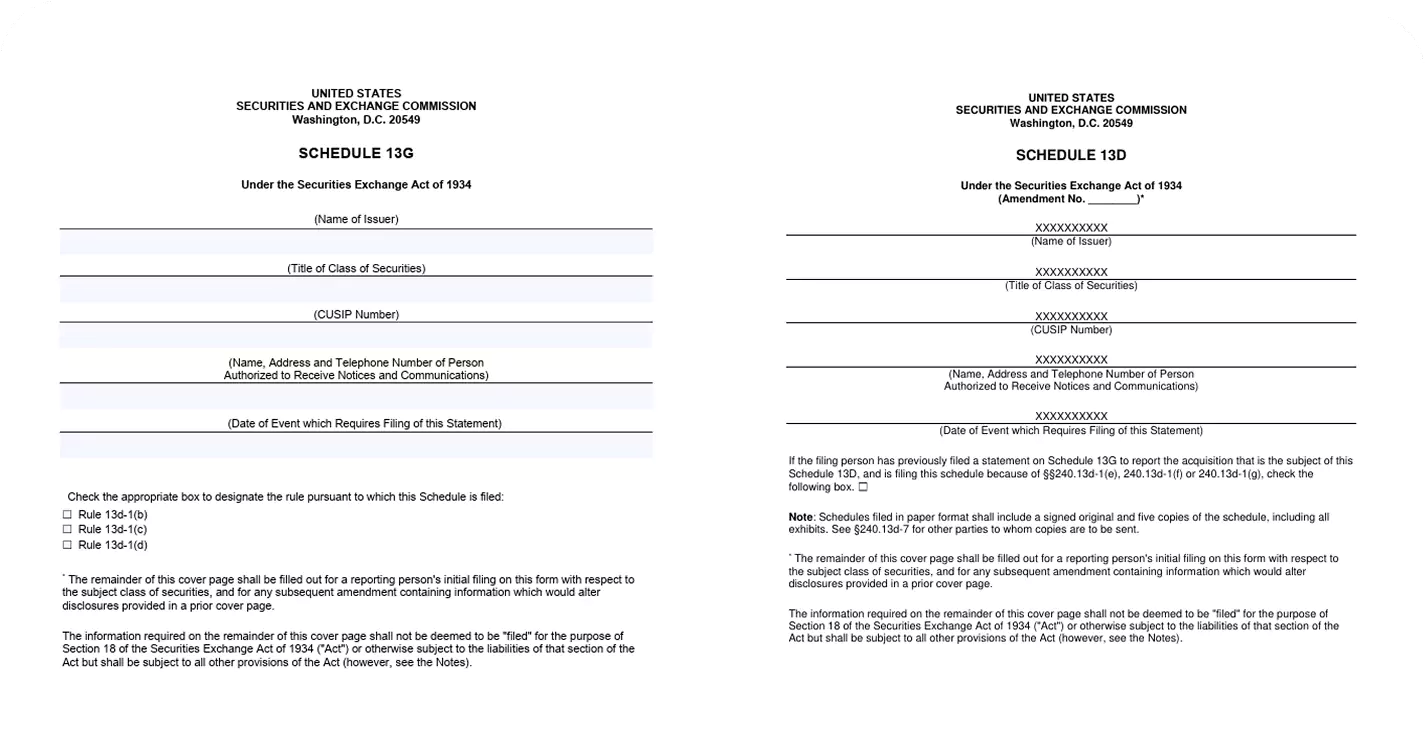

Schedules 13D and 13G are beneficial ownership reports filed with the SEC. Any individual or entity that acquires more than 5% of a registered class of a company's equity securities must file one of these schedules.

- Schedule 13D: The long-form disclosure required for active investors who may influence or control the company.

- Schedule 13G: A shorter, simplified disclosure available for passive investors and certain institutional investors.

- Deadline: Must generally be filed within 10 days of crossing the 5% threshold, with amendments required for material ownership changes.

- Why it matters: Provides transparency into large shareholders’ intentions and influence over a public company.

Why Schedule 13D / 13G Filing is Important

These filings complement Form 3, 4, and 5 filings under Section 16 by providing visibility into major ownership stakes, not just insider transactions.

Regulatory Requirement

Failure to file can result in SEC enforcement actions and penalties.

Investor Awareness

Signals to the market whether ownership changes are passive investments or potential activism.

Corporate Governance

Helps boards and management understand the shareholder landscape.

Ongoing Compliance

Amendments are required for significant changes, reducing the risk of SEC rejections.

How Form345 Simplifies Your Schedule 13D / 13G Filing

Form345.com eliminates the complexity of ownership reporting by integrating Schedule 13D / 13G filings into the same streamlined platform you already use for Section 16 filings. Whether you are managing one insider or a group of beneficial owners, our Section 16 software ensures compliance with every disclosure requirement. Our key features include:

Ownership disclosure tailored for both 13D (detailed) and 13G (simplified) filings.

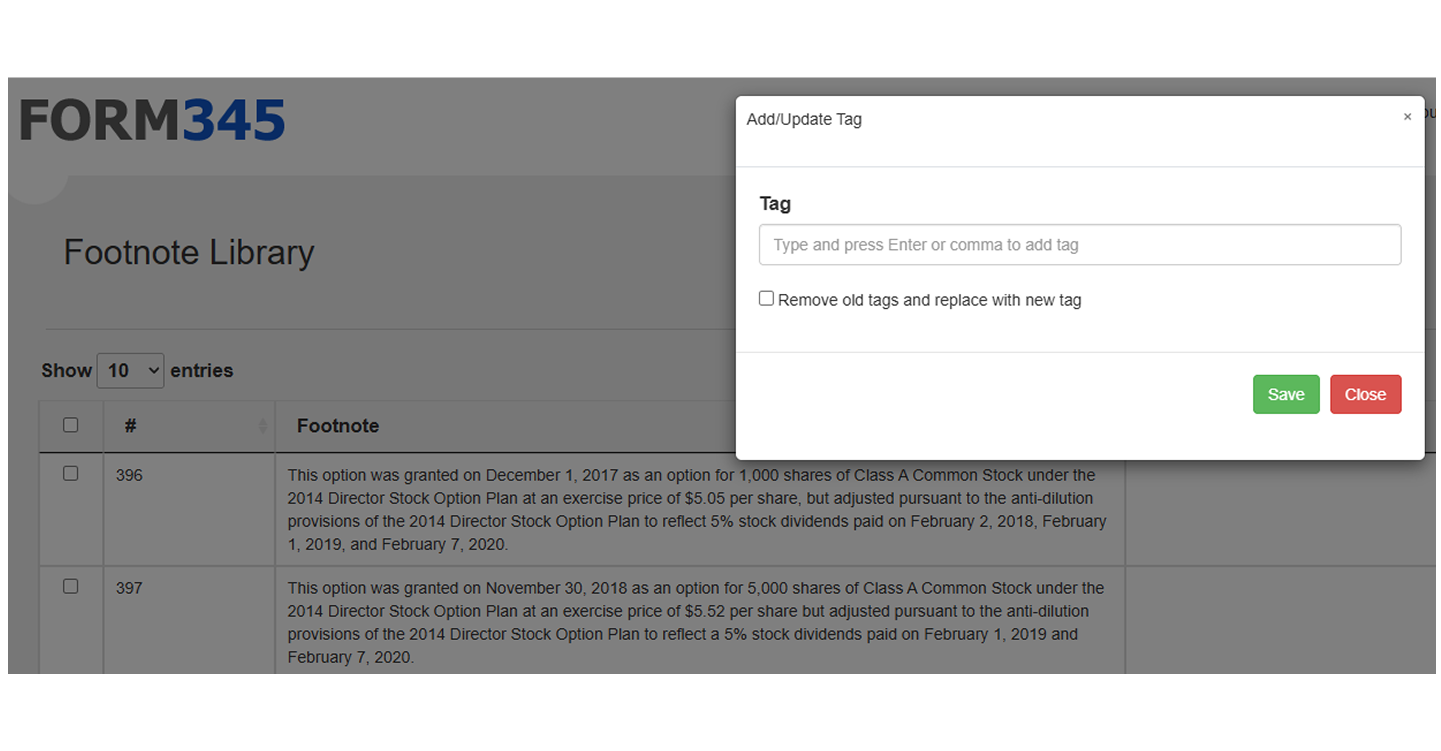

Smart tagging to correctly classify reporting persons, footnote data, and more.

Deadline tracking so you never miss initial or amendment deadlines.

Printable proofs & audit trails for legal and compliance teams.

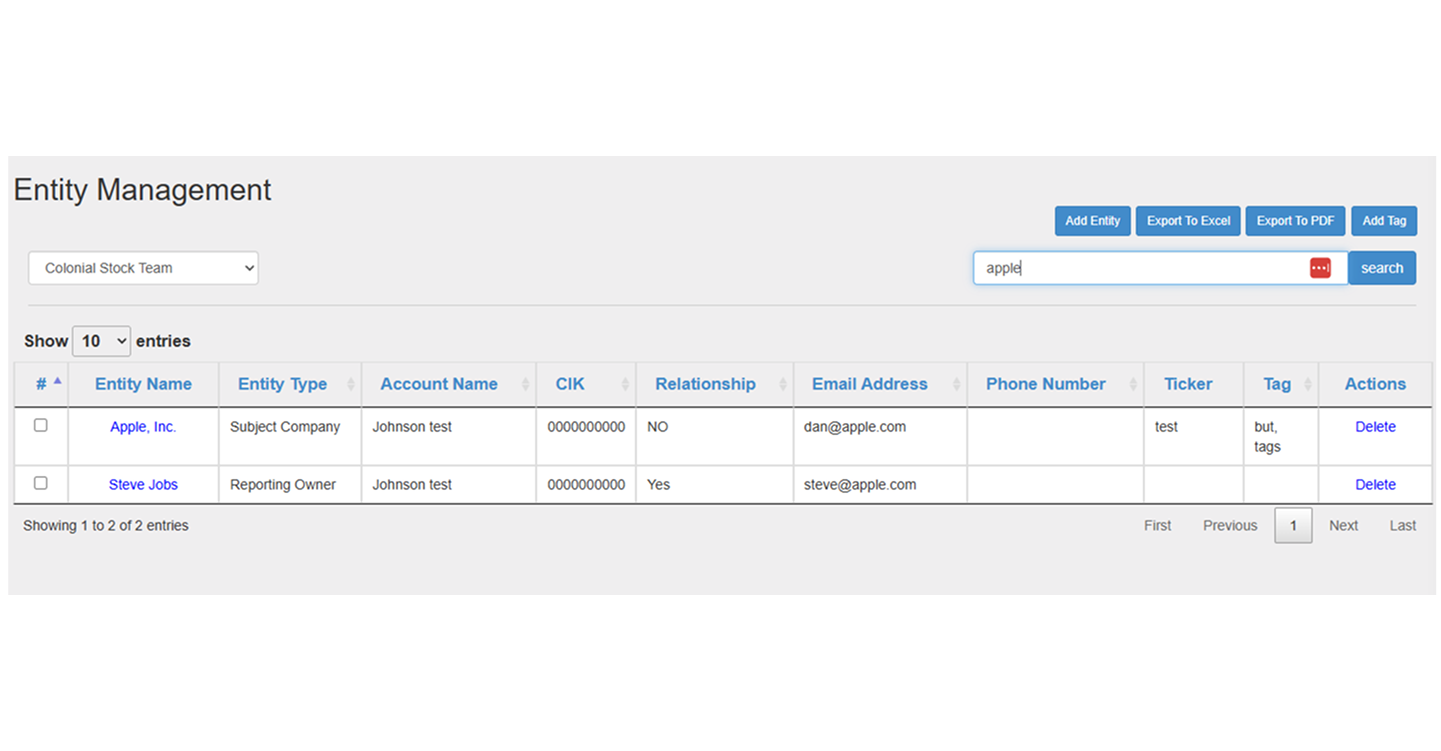

Centralized filer management to handle multiple beneficial owners across funds or institutions.

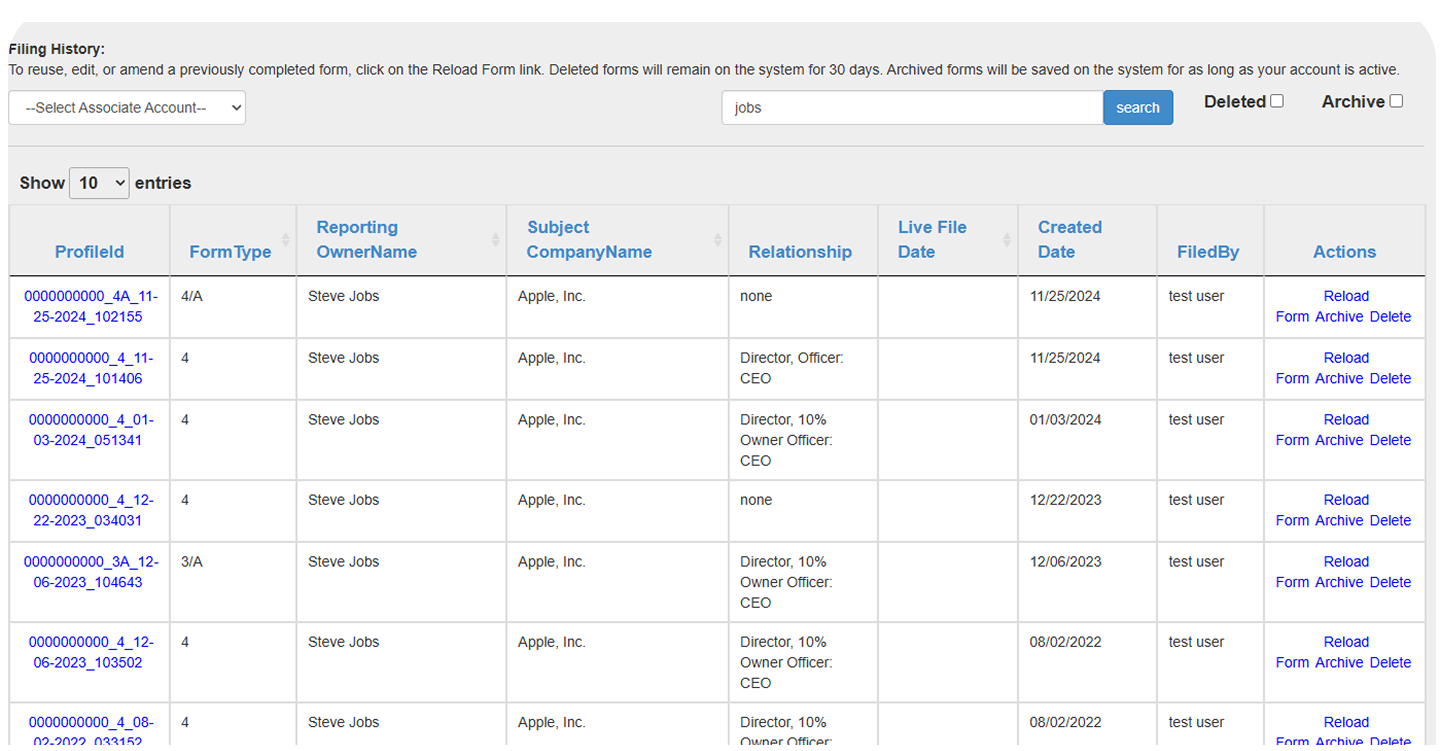

Submission history access Submission history access for reviewing past disclosures and amendments.

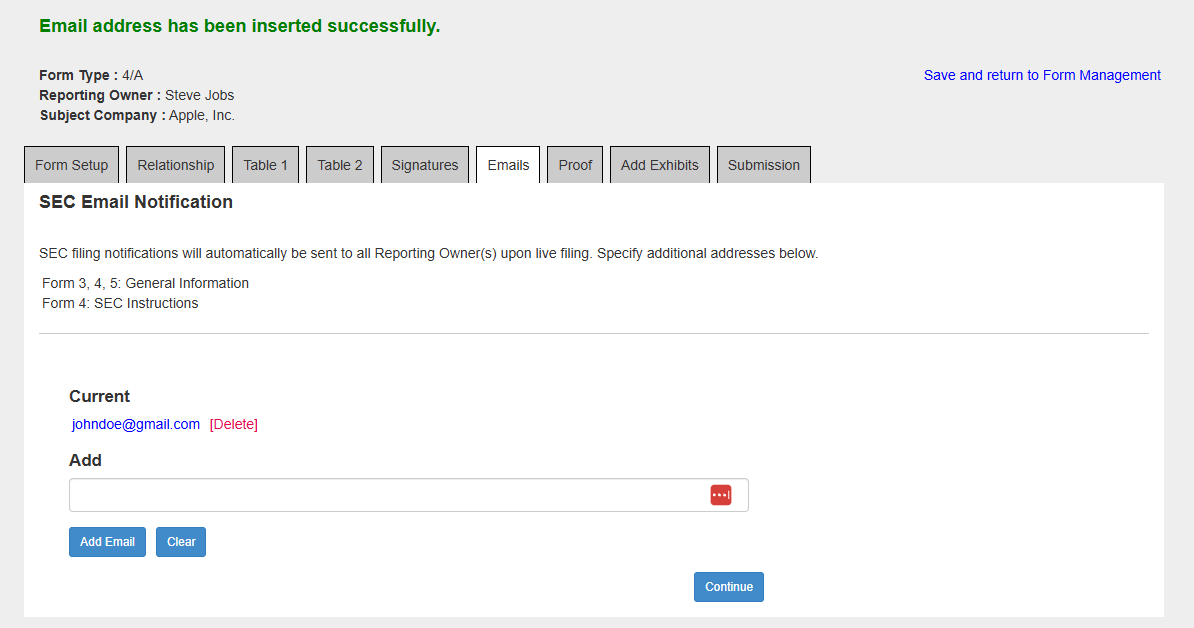

Instant email confirmations verifying successful SEC submission.

Our Filing Process

The filing steps for Schedule 13D / 13G filings are consistent with our process for Form 3, Form 4 and Form 5 filings, making it easy for teams already managing insider reporting to extend their compliance workflows:

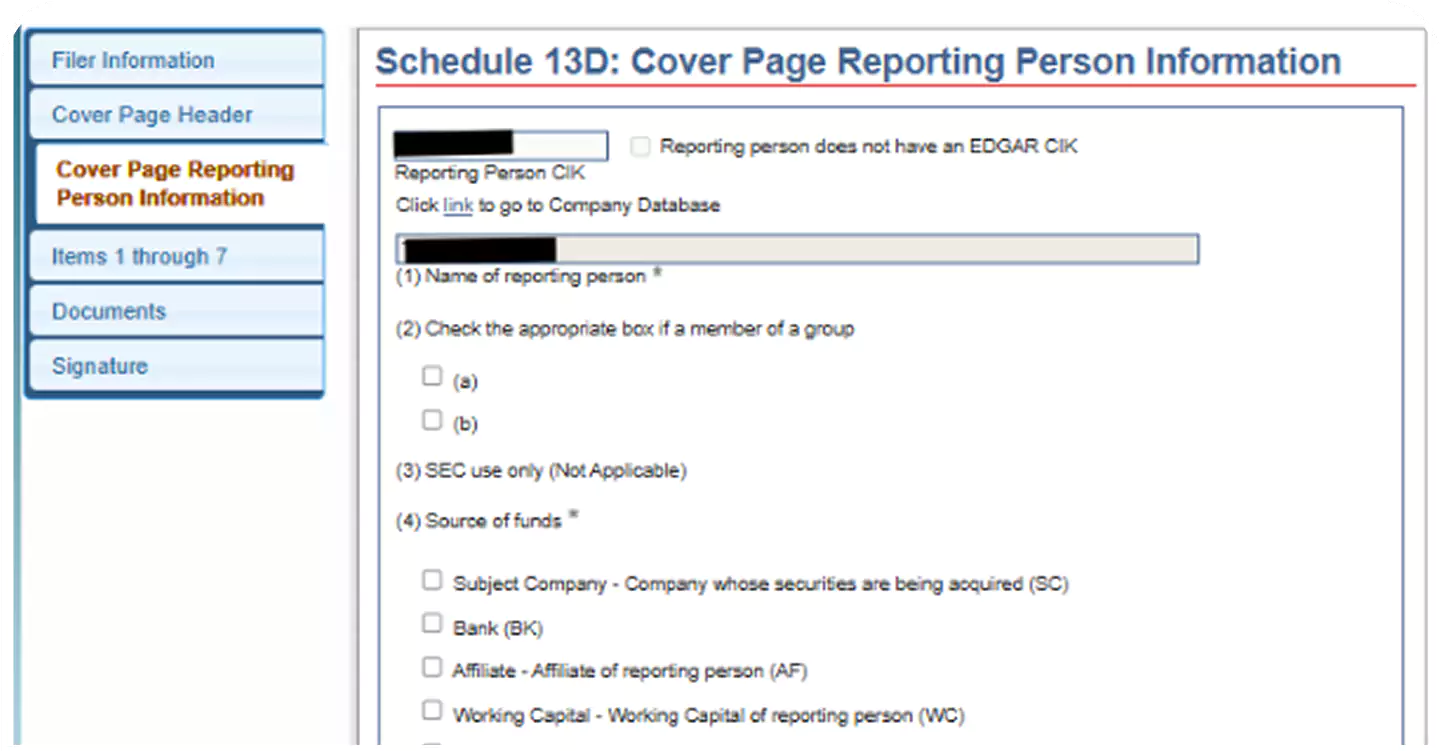

Step 1: Enter Information

Quickly input insider details and ownership data into our guided form. No need to worry about missing fields—our platform prompts you for everything required.

Step 2: Create Filers

Set up insider profiles once and reuse them across multiple filings. This saves time when filing for multiple executives or beneficial owners.

Step 3: Create Form

Generate your Schedule 13D and 13G filings easily. Our system EDGARizes and tags data in proper SEC XML-based formats required for these forms.

Step 4: Validate

Before submission, the platform runs built-in compliance checks to catch errors, omissions, or formatting issues. This reduces the risk of SEC rejections.

Step 5: Submit

File directly to the SEC’s EDGAR system with one click. You’ll receive confirmation emails and can download proof copies for your records.

This 5-step workflow is intuitive, automated, and eliminates the need to be an EDGAR expert.

Get Started with Schedule 13D / 13G Today

Don't let compliance delays or formatting errors get in the way of your responsibilities. With Form345.com, you can ensure that your Schedule 13D / 13G is submitted accurately, on time, and in full compliance.

Contact us for a demo and start your Schedule 13D / 13G filing today with confidence.