Form 144 Filing Made Simple

Stay Compliant When Selling Rule 144 Stock

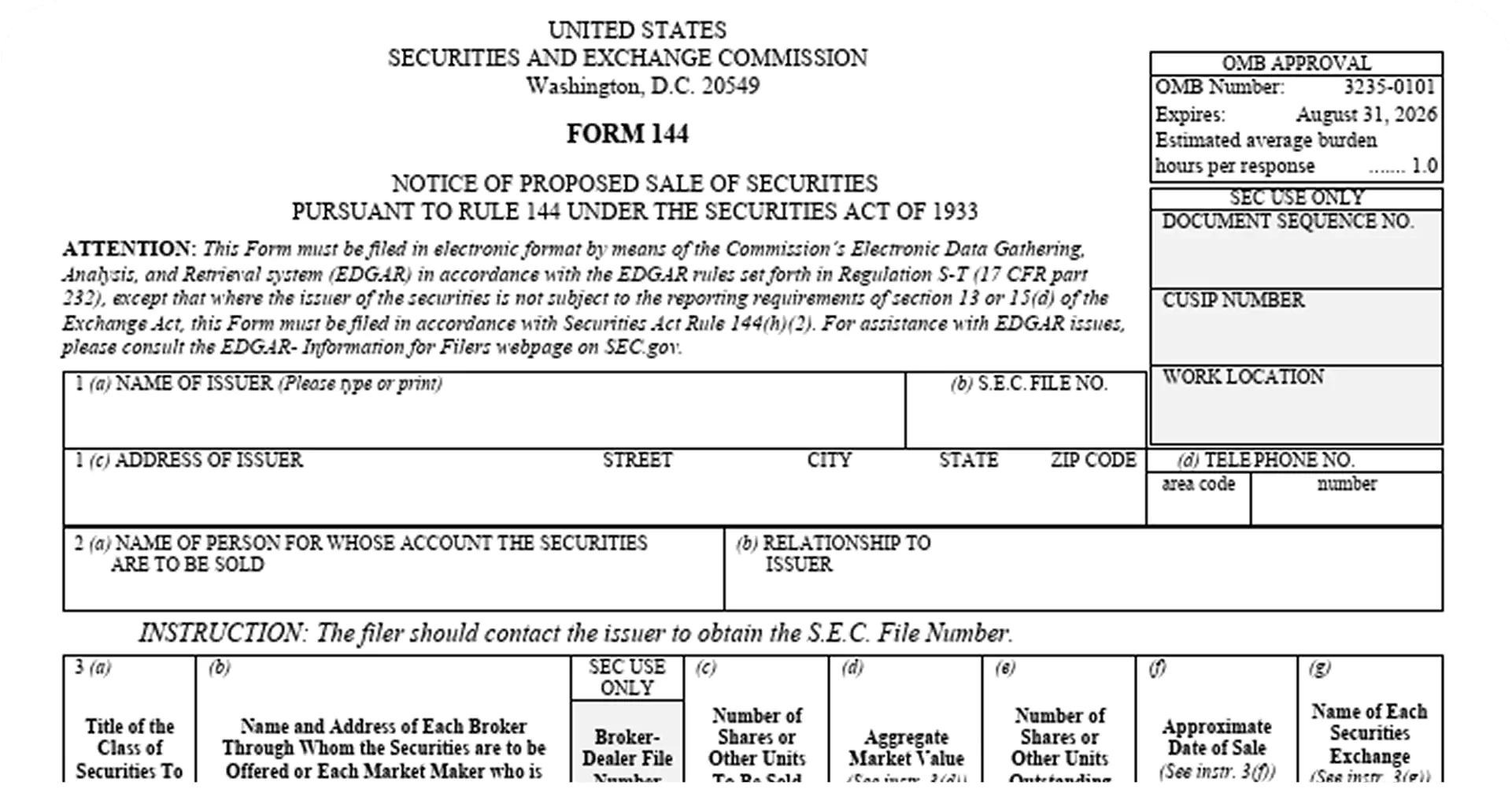

What is Schedule Form 144?

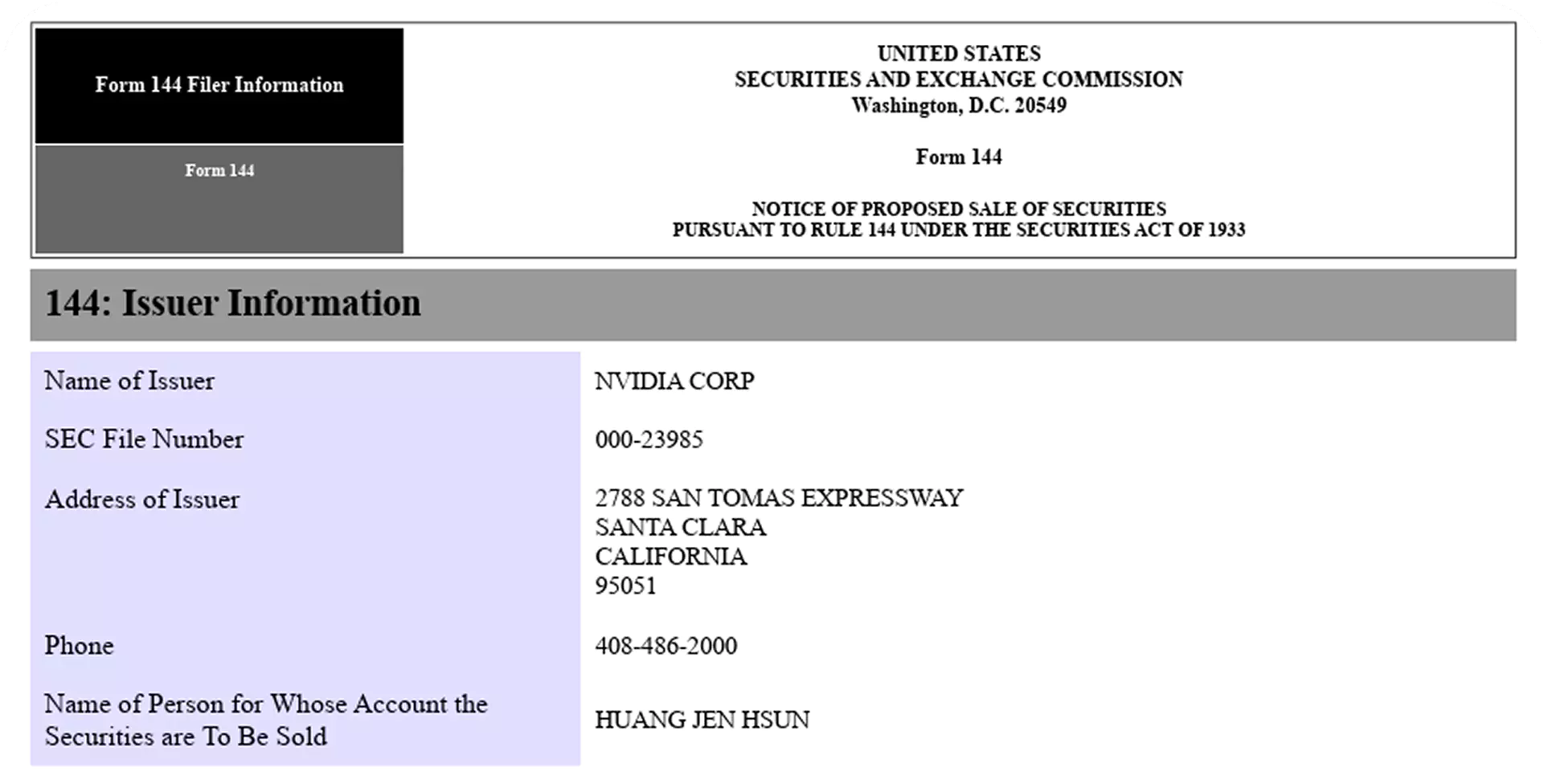

Form 144 is the notice of proposed sale of restricted or control securities filed with the SEC. It must be submitted when corporate insiders or affiliates of a company plan to sell restricted, unregistered, or control stock under Rule 144.

- Who files: Officers, directors, and affiliates of the issuer, or anyone selling restricted stock.

- Thresholds: Required if the proposed sale exceeds 5,000 shares or $50,000 in value within a three-month period

- Why it matters: Alerts the market and regulators that insiders or affiliates intend to sell significant holdings.

Why Form 144 Filing is Important

Form 144 filings provide transparency to both investors and regulators about potential insider sales of securities. These disclosures are closely watched for signals about insider sentiment and corporate governance.

Regulatory Compliance

Required under SEC Rule 144 to lawfully sell restricted or control securities.

Investor Awareness

Ensures shareholders are aware when significant insider or affiliate sales are planned.

Market Transparency

Reduces the risk of insider trading concerns by making sales intentions public

Strict Requirements

Failing to properly file Form 144 may block the proposed sale or result in SEC penalties.

How Form345 Simplifies Your Form 144 Filing

Form345.com takes the complexity out of preparing and submitting Form 144. Whether you're an insider, attorney, or compliance professional, our platform ensures accurate filings that meet SEC rules. Whether you are filing on behalf of a single insider or managing multiple affiliates planning sales, our Section 16 software ensures compliance with every disclosure requirement. Our key features include:

Self-filing of Form 144 to the SEC for notice filings under Rule 144.

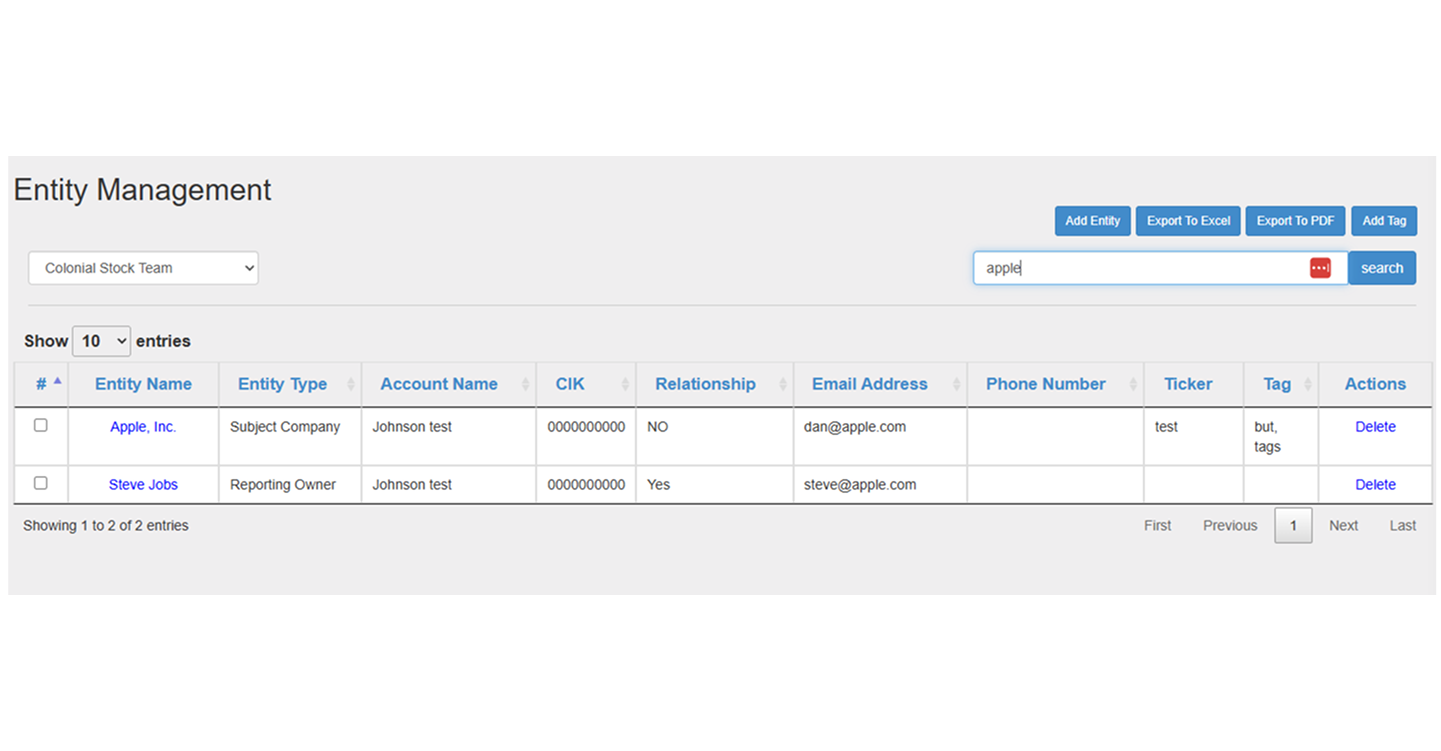

Auto-population of filer and entities, footnotes, etc.

Printable proofs & audit trails for legal and compliance teams.

Centralized filer management to oversee multiple insiders or affiliates.

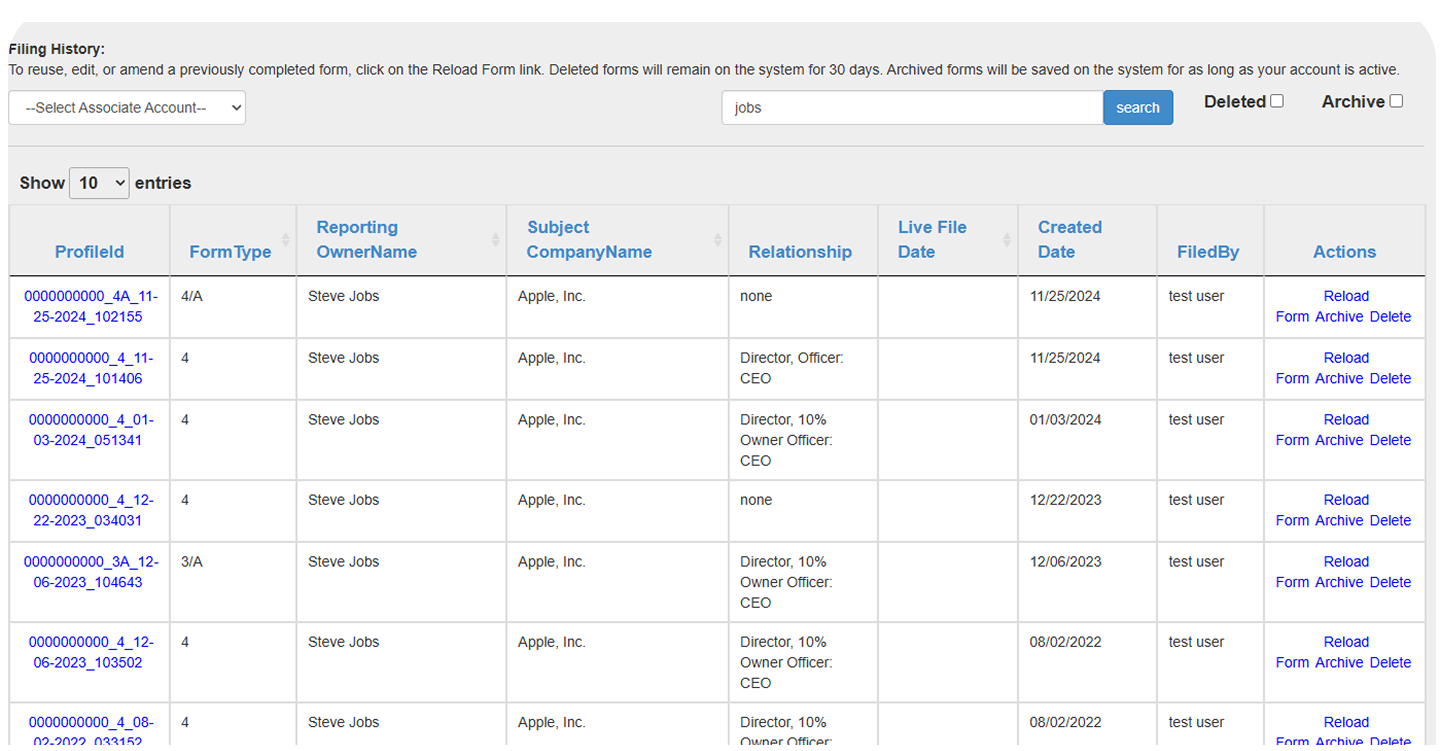

Submission history access for reviewing prior Form 144 notices.

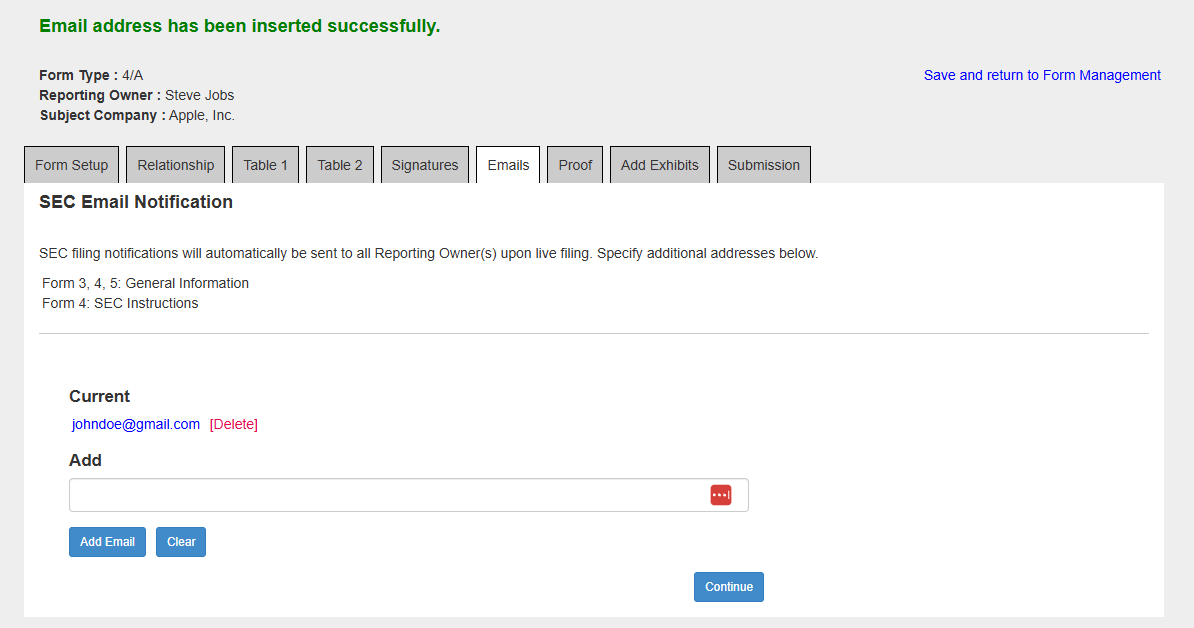

Instant email confirmations verifying successful SEC submission.

Our Filing Process

The filing steps for Schedule 13D / 13G filings are consistent with our process for Form 4, Form 4 and Form 5filings, making it easy for teams already handling insider reporting to manage Rule 144 compliance seamlessly:

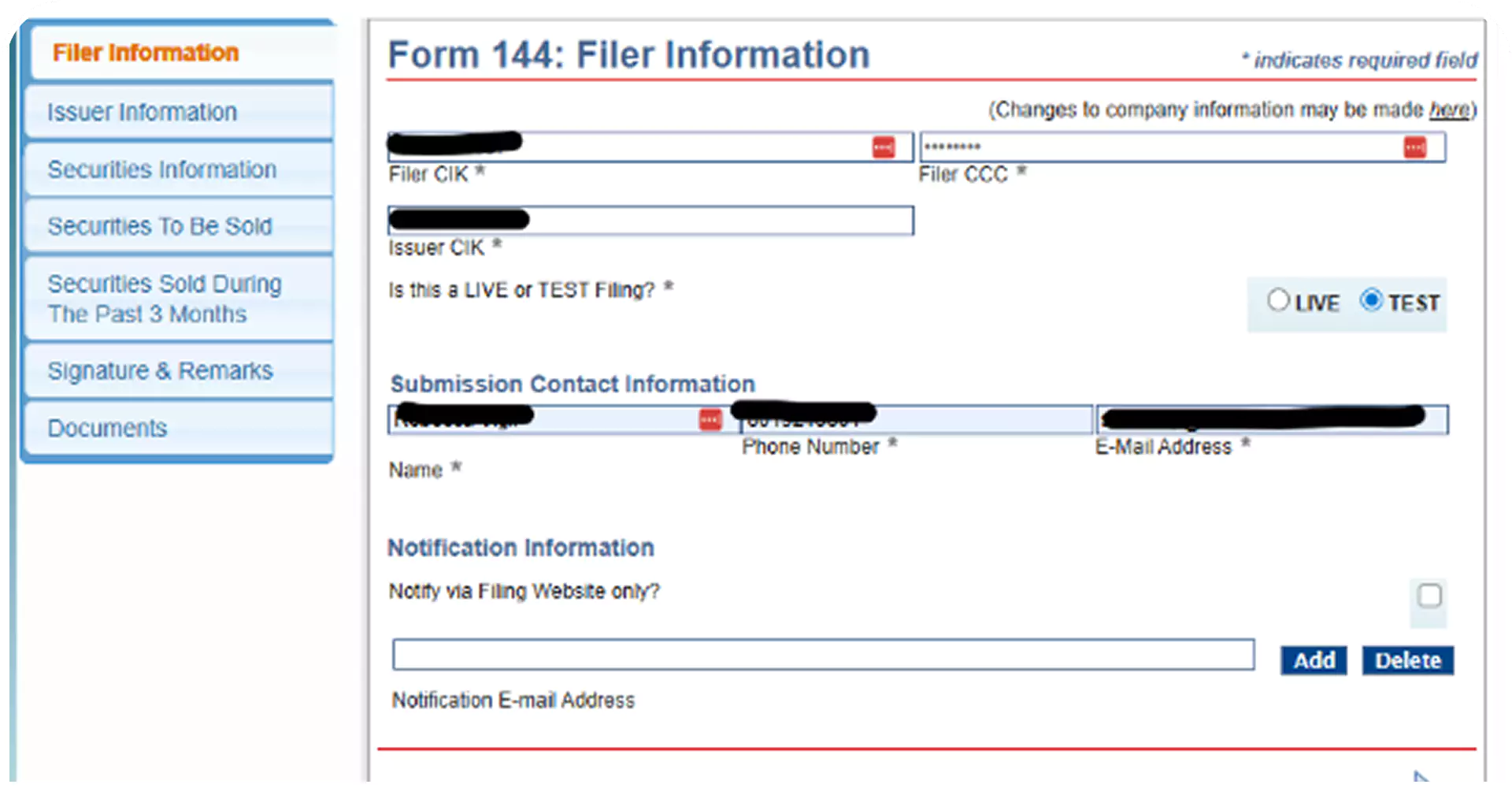

Step 1: Enter Information

Quickly input insider details and ownership data into our guided form. No need to worry about missing fields—our platform prompts you for everything required.

Step 2: Create Filers

Set up insider profiles once and reuse them across multiple filings. This saves time when filing for multiple executives or beneficial owners.

Step 3: Create Form

Generate your Form 144 easily. Our system puts your form into EDGAR compatible formats ready for SEC submission.

Step 4: Validate

Before submission, the platform runs built-in compliance checks to catch errors, omissions, or formatting issues. This reduces the risk of SEC rejections.

Step 5: Submit

File directly to the SEC’s EDGAR system with one click. You’ll receive confirmation emails and can download proof copies for your records.

This 5-step workflow is intuitive, automated, and eliminates the need to be an EDGAR expert.

Get Started with Form 144 Filing Today

Don't let compliance delays or formatting errors get in the way of your responsibilities. With Form345.com, you can ensure that your Form 144 is submitted accurately, on time, and in full compliance.

Contact us for a demo and start your Form 3 filing today with confidence.